Every year, Americans spend over $650 billion on prescription drugs. That’s more than any other country in the world. But here’s the surprising part: 90% of all prescriptions filled are for generic drugs - yet they make up only 12% of total spending. Meanwhile, brand-name drugs, which account for just 10% of prescriptions, soak up 88% of the money. This isn’t a glitch. It’s the power of generics at work.

What Exactly Are Generic Drugs?

Generic drugs aren’t cheap copies. They’re exact replicas of brand-name medications, down to the active ingredient, dosage, strength, and how they work in your body. The FDA requires them to meet the same strict standards for safety, purity, and effectiveness. The only differences? The name, the color, the shape, and the inactive ingredients - like fillers or dyes - which don’t affect how the drug works. For example, if you’re taking metformin for diabetes, you’re likely taking a generic. The brand version, Glucophage, costs about $200 for a 30-day supply. The generic? Around $4. Same drug. Same results. A 98% drop in price. The FDA’s approval process for generics is called an ANDA - Abbreviated New Drug Application. Instead of running full clinical trials (which can cost billions and take over a decade), generic manufacturers prove their version is bioequivalent. That means it delivers the same amount of active ingredient into your bloodstream at the same rate as the brand-name drug. The FDA tests this by comparing blood levels in 24-36 healthy volunteers over 72 hours. If the results fall within 80-125% of the brand’s, it’s approved.How Much Money Are We Really Saving?

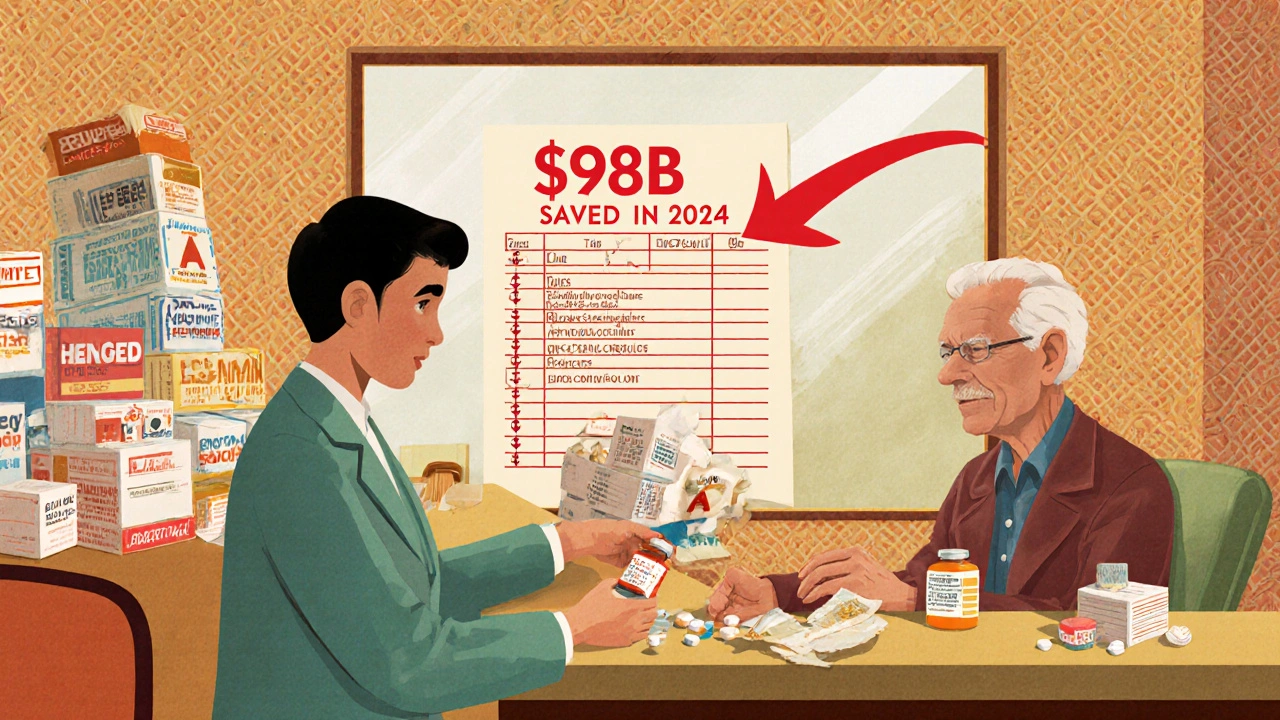

In 2024, generic drugs saved the U.S. healthcare system $98 billion in direct spending. That’s not a guess - it’s from the Association for Accessible Medicines’ official report. Since 1984, when the Hatch-Waxman Act made it easier to approve generics, the total savings have hit over $445 billion. That’s enough to cover the annual healthcare costs of 15 million Americans. Here’s how it breaks down:- Generics: 90% of prescriptions, 12% of total spending

- Brand-name drugs: 10% of prescriptions, 88% of total spending

Why Don’t Generics Save More?

You’d think with such massive savings, everyone would be pushing generics. But the system isn’t designed that way. One major roadblock? Patent thickets. Brand-name companies file dozens - sometimes over 140 - patents on a single drug. These aren’t all about the medicine itself. Some cover packaging, dosing schedules, or even the color of the pill. Each one delays generic entry. On average, it takes 28 months after a patent expires before a generic hits the market. Some drugs face delays of 5+ years. Then there’s pay-for-delay. This is when a brand-name company pays a generic manufacturer to stay off the market. The FTC says these deals delay generic entry by 17 months on average and cost consumers $3.5 billion a year. They’re legal - for now. Another issue? Pharmacy Benefit Managers (PBMs). These middlemen negotiate rebates with drugmakers. But here’s the twist: sometimes, a brand-name drug gives a bigger rebate to the PBM than a generic does. So the PBM puts the brand drug on the preferred list - even if it costs more. You might pay a $10 copay for a brand-name drug and $15 for the generic. That’s backwards. But it happens in 45% of commercial insurance plans.

The Biosimilar Gap

Biologics - complex drugs made from living cells - are the new frontier in drug spending. They treat cancer, rheumatoid arthritis, and autoimmune diseases. But they’re expensive. Humira, for example, costs over $7,000 a month. The first biosimilar (a similar, not identical, version) didn’t arrive until over 15 years after Humira’s launch. Biosimilars cost 15-35% less than their brand-name counterparts. That’s far less than the 80% drop you see with small-molecule generics. Why? Because biosimilars are harder and costlier to develop. The FDA requires more testing. And many manufacturers don’t bother. Right now, 90% of biologics that are about to lose patent protection have no biosimilar in development. That’s a $133 billion missed opportunity by 2025, according to the RAND Corporation. In Europe, biosimilar adoption is 70-85%. In the U.S., it’s 25-30%. Why? Rebates. PBMs still favor brand-name biologics because the rebates are bigger.Real People, Real Savings

Behind these numbers are real lives. A Reddit user shared how switching their mom from brand-name Humalog insulin to the generic saved $325 a month - money that kept her from skipping doses. GoodRx’s 2024 report found that 68% of patients skip or split pills when generics aren’t available. Nearly half of Medicare Part D users skip doses because they can’t afford brand-name drugs. But with generics, that number drops to 12%. On Drugs.com, generic drugs have a 4.1 out of 5 rating. Brand-name drugs? 4.3. The difference? Affordability. Generics score 4.5 out of 5. Brands? 2.3. One patient wrote: “I used to choose between insulin and groceries. Now I can afford both.”Where Generics Fall Short

Generics aren’t perfect. For drugs with a narrow therapeutic index - like warfarin (blood thinner) or levothyroxine (thyroid hormone) - even tiny differences in absorption can matter. Some patients report symptoms returning after switching to a generic. The FDA says these cases are rare and often due to individual sensitivity, not poor quality. But they’re real enough that 12 states require doctors to specifically authorize generic substitution for these drugs. In 2023, the FDA received 1,247 adverse event reports linked to generic substitutions. Most were gastrointestinal issues from different fillers - like lactose or dyes - not the active drug. For people with allergies or sensitivities, that matters. Also, 80% of the active ingredients in U.S. generics come from India and China. During the pandemic, supply chain disruptions caused over 300 drug shortages - mostly generics. That’s not a flaw in the drug. It’s a flaw in how we make them.

What’s Changing?

The Inflation Reduction Act capped insulin at $35 a month for Medicare patients. That forced manufacturers like Eli Lilly to drop their list prices from $275 to $25. That’s not because of negotiation. It’s because generics made the brand uncompetitive. The FDA is speeding up biosimilar reviews. GDUFA III, their latest funding agreement, is pushing for better tools to test complex generics. But progress is slow. The Congressional Budget Office says Medicare drug price negotiation could save $500 billion over ten years. But they also say: “Generic competition produces substantially greater savings per drug than negotiation.” Why? Because negotiation only applies to a handful of drugs each year. Generics apply to everything.What You Can Do

If you’re on a brand-name drug, ask your doctor or pharmacist: “Is there a generic?” If there is, it’s almost always cheaper - even with insurance. Check GoodRx or SingleCare. Often, the cash price for a generic is lower than your insurance copay. If your plan charges more for generics, ask why. It might be a PBM quirk. You can appeal. If you’re on a narrow therapeutic index drug and feel different after switching, tell your doctor. It’s not always the drug. But it’s worth investigating.Final Thought

Generics aren’t a band-aid. They’re the backbone of affordable healthcare. Without them, millions would go without medication. Without them, Medicare and Medicaid would collapse under the weight of drug prices. The system still has holes - patent games, rebate distortions, supply chain risks. But the core truth hasn’t changed: generics work. They’re safe. They’re effective. And they save billions - every single year.Are generic drugs as safe and effective as brand-name drugs?

Yes. The FDA requires generic drugs to have the same active ingredient, strength, dosage form, and route of administration as the brand-name version. They must also prove bioequivalence - meaning they deliver the same amount of medicine into your bloodstream at the same rate. Over 90% of generics are rated as therapeutically equivalent by the FDA. Millions of patients use them safely every day.

Why are generics so much cheaper?

Generics don’t need to repeat expensive clinical trials because they’re proven to be equivalent to an already-approved brand-name drug. The development cost for a generic is typically under $2 million, compared to $2.6 billion for a new brand drug. Generic manufacturers also compete with each other, driving prices down further. Once multiple generics enter the market, prices often drop by 90% within a year.

Can I switch from a brand-name drug to a generic without consulting my doctor?

In most cases, yes - pharmacists can substitute generics unless your doctor specifically writes "Dispense As Written" or "Do Not Substitute." However, for drugs with a narrow therapeutic index - like warfarin, levothyroxine, or certain seizure medications - your doctor may prefer you stay on the same version. Always check with your provider if you’re unsure.

Why does my insurance charge more for a generic than a brand-name drug?

This usually happens because of how Pharmacy Benefit Managers (PBMs) structure rebates. Sometimes, the brand-name drug gives a larger rebate to the PBM than the generic does. So the PBM makes more money if you pay more for the brand. It’s not about cost - it’s about profit. Ask your insurer for a formulary list and compare copays. You can often appeal or switch plans.

Are there any drugs that don’t have generics?

Yes. Some drugs are too complex to copy easily - like biologics (e.g., Humira, Enbrel), inhalers, or certain injectables. These are called complex generics or biosimilars, and they take longer to develop. Also, drugs with very small patient populations - like some orphan drugs - may not have generics because there’s little financial incentive for manufacturers to make them. But over 92% of small-molecule drugs have generic versions within a year of patent expiration.

Peter Aultman

November 14, 2025 AT 16:08Generics are the unsung heroes of American healthcare. I used to think they were sketchy until my dad switched from Lipitor to atorvastatin and saved $180 a month. He’s been on it for five years now, no issues, no side effects. The FDA doesn’t mess around with approvals. If it’s on the shelf, it works.

Barry Sanders

November 15, 2025 AT 07:11Let’s be real - generics are just corporate greed in disguise. The FDA’s bioequivalence window is 80-125%? That’s not equivalence, that’s a gamble. People die from inconsistent absorption. This isn’t healthcare, it’s pharmaceutical roulette.

Dilip Patel

November 15, 2025 AT 14:48India makes 80% of the world’s generics and you’re still whining? We produce better quality than your overpriced brand names. Your system is broken not because generics are bad but because your PBMs are crooks. Stop blaming the medicine and start blaming the middlemen.

Jane Johnson

November 15, 2025 AT 17:21While I appreciate the data presented, one must consider the ethical implications of widespread generic substitution in vulnerable populations. The psychological impact of perceived inferiority, even when clinically unfounded, can significantly affect adherence and outcomes.

Brittany C

November 16, 2025 AT 23:49The PBM rebate structure is a classic principal-agent problem. The incentives are misaligned - PBMs optimize for their own margin, not patient cost. This isn’t a market failure; it’s a regulatory capture. We need structural reform, not just patient education.

Brian Bell

November 18, 2025 AT 15:36My grandma takes generic levothyroxine and she’s fine. But I get it - if you feel weird after switching, tell your doc. No shame. I switched my blood pressure med last year and my head spun for a week. Turned out it was the filler. Weird stuff.

kshitij pandey

November 19, 2025 AT 20:24Generics are why my cousin in rural India gets her diabetes meds for $1 a month. In the US, we argue about rebates while people skip doses. This isn’t just about money - it’s about dignity. Every pill matters. Keep pushing for access, not just savings.

Sean Hwang

November 21, 2025 AT 07:25Had a friend on Humira for RA. Switched to biosimilar. Paid $15 instead of $7k. Same results. No drama. FDA approved it. People need to stop fearing generics. They’re not cheap because they’re bad - they’re cheap because they don’t need to pay for ads and fancy packaging.

Nathan Hsu

November 21, 2025 AT 08:23Let’s not forget: the Hatch-Waxman Act of 1984 was revolutionary - but it’s been weaponized. Patent thickets? Pay-for-delay? These aren’t market forces - these are legal loopholes designed to protect monopolies. We need Congress to act, not just patients to ask for generics.

Chris Ashley

November 21, 2025 AT 19:05Just got my insulin prescription filled - generic lispro cost $22. Brand was $340. I didn’t even know I could switch. Why isn’t this front page news? Why do we let corporations get away with this?

Ashley Durance

November 22, 2025 AT 18:04Generics save money, sure. But they also normalize underinvestment in R&D. Who’s going to develop the next breakthrough if every drug gets copied the second the patent expires? Innovation needs profit - and right now, we’re killing it with price caps and generics.